Institutional Insights: Credit Agricole FX Weekly 13-2-26

As central banks globally attempt to reassure the markets that only a minor recession may be necessary to rein in inflation, anxiety about a significant economic downturn appears to be escalating. The recent situation in the UK has underscored that any unfinanced government spending initiatives aimed at stimulating growth may exacerbate inflation concerns and jeopardise financial stability, complicating the task for central banks. Even as central banks strive to be forthright with the markets and acknowledge a recession as a likely scenario—much like the BoE has done since May—this strategy risks undermining their credibility in combating inflation. Consequently, this could negatively impact the currency and contribute to higher inflation.

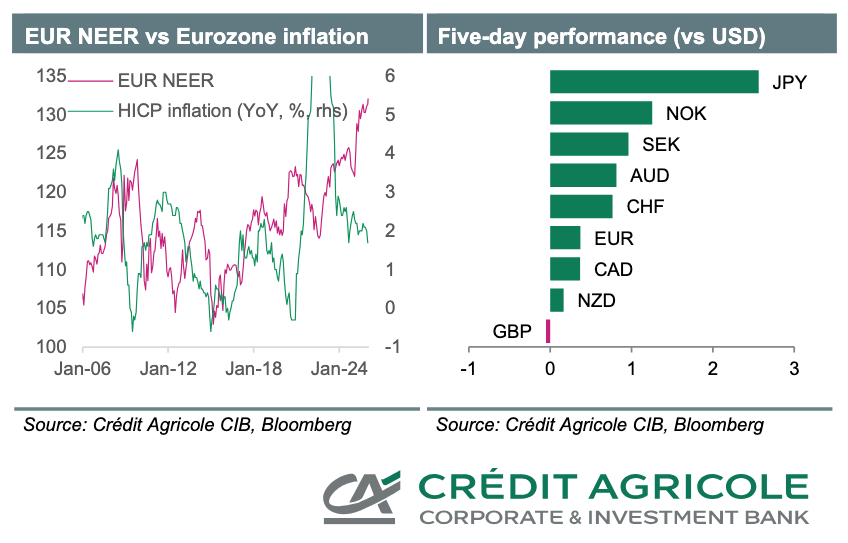

Despite increasing downside risks to the Eurozone’s economic outlook, the ECB continues to highlight upside risks related to inflation while minimising growth risks. Although the bank has been somewhat ambiguous regarding the extent of additional policy normalisation required, it hasn't resisted the accumulation of hawkish market expectations concerning interest rate hikes, as such expectations aid the stability of EUR/USD. We believe that these hawkish expectations may be challenged as Eurozone economic data deteriorates further in the upcoming months, potentially forcing the Governing Council to be more transparent with the markets about the likelihood of a hard landing in the Eurozone and its implications for monetary policy.

Ahead of the ECB meeting in October, the Governing Council is expected to raise rates by 75 basis points, as anticipated by the market, but it should also indicate that the pace of policy normalisation will decelerate from that point onwards and that quantitative tightening is not on the immediate horizon. This would suggest a cautious outlook for the EUR at current levels.

The weakening Japanese yen and rising inflation will likely prevent the BoJ from shifting away from its ultra-loose monetary policy. Despite the BoJ's adjustment of its inflation forecasts upward, we expect inflation to fall below its target in 2023. Nonetheless, investors will be watching for any changes in the BoJ’s future guidance.

Meanwhile, the Bank of Canada may find itself in a dilemma between further easing its tightening pace with a 50 basis points hike and keeping pace with the Fed’s 75 basis points increases.

The strong U.S. dollar is expected to maintain its dominance in the foreign exchange markets, bolstered by the ongoing sell-off in the U.S. fixed income market, which has recently raised concerns about a potential scarcity of U.S. dollars. Liz Truss’s resignation might imply a continued period of political instability in the UK, keeping the British pound under pressure.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!